Starting 6th April, the Landlords Energy Saving Allowance, a tax incentive designed to help landlords’ transition to the new rules implemented under The Energy Act of 2011, will expire. This means landlords will have to hurry to make improvements in order to claim the tax break on their self-assessed income tax.

Over the next three years the act specifies new environmental standards landlords must meet in order to let out their properties. This will mean many are required to make improvements in the form of new boilers, added insulation, or new energy efficient windows in order to improve the overall efficiency of the property. Until 6th April landlords may claim £1500 of this expense against their taxes.

The new rules have met little resistance from the National Landlords Association, and other industry bodies in England and Wales. Despite the fact the regulations impact between 8 and 10 per cent of the properties currently in rental contracts in England and Wales. This is because the government has offered a range of generous incentives to help landlords bring their properties up to the new standard.

Tenants stand to gain from the new regulations, with savings from energy improvements estimated to be £880 per year. They have also gained the right to ask their landlord to make reasonable improvements to the property’s energy efficiency, a request the landlord cannot unreasonably deny.

The Act & Rules: Timeline

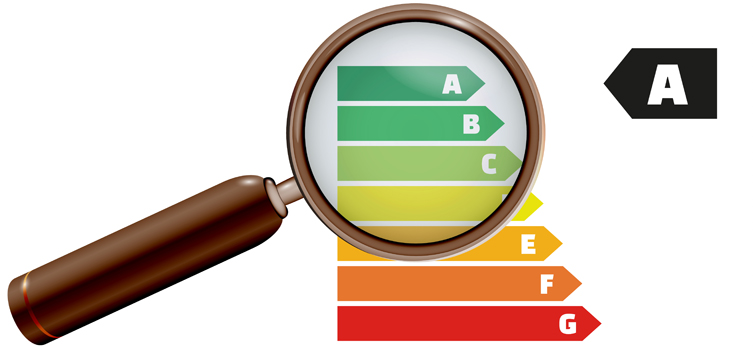

Under the new rules implemented last year landlords have three years to make improvements to their properties to improve their energy efficiency. In this time they must obtain an Energy Performance Certificate or EPC. All buildings are rated from ‘A’ to ‘G’ depending on their level of efficiency with A being most efficient and G least. The act will require landlords to have a minimum of an ‘E’ rating to be allowed to let a property.

April 2016 the Act grants tenants the right to require the landlord make reasonable energy efficiency improvements to the property. This means if a tenant asks, the landlord in reasonable time, must upgrade the property to at least the minimum-passing grade.

After 1st April, 2018 no property in England or Wales may be let by any landlord if it does not have an EPC certificate with a rating of ‘E’ or higher. Existing tenants can stay in a property until the end of their lease but cannot renew. Landlords attempting to let a property with an illegal energy efficiency level face fines or prosecution.

Grants and Schemes

Until 6th April 2015, a landlord can deduct up to £1,500 of improvements from their taxes, making it important for landlords hoping to capitalize on this free money to get their renovations started immediately.The Green Deal program also allows landlords to receive an additional £5600 in the form of a Green Deal loan. These loans are repaid via tenant’s energy bills; in order to qualify a Green Deal assessment is required. As these take time, it is recommended to book one as soon as possible.

Until 31st May landlords may also be eligible to obtain a grant from the ECO or Energy Companies Obligation Fund. It is anticipated after this that funding for the program will be drastically cut, meaning it is important for landlords to act quickly in order to obtain some of this free funding before it disappears.